| High-quality Wireless Spatial Audio WiSA Technologies, Inc. Q2 2023 Presentation August 15, 2023 |

| Forward Looking Statements This presentation of WiSA Technologies, Inc. (NASDAQ: WISA) (the “Company” or “WiSA”) contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Readers are cautioned not to place undue reliance on these forward-looking statements. Actual results may differ materially from those indicated by these forward-looking statements as a result of risks and uncertainties impacting WiSA’s business including, current macroeconomic uncertainties associated with the COVID-19 pandemic, our inability to predict or measure supply chain disruptions resulting from the COVID-19 pandemic and other drivers, our ability to predict the timing of design wins entering production and the potential future revenue associated with design wins; rate of growth; the ability to predict customer demand for existing and future products and to secure adequate manufacturing capacity; consumer demand conditions affecting customers’ end markets; the ability to hire, retain and motivate employees; the effects of competition, including price competition; technological, regulatory and legal developments; developments in the economy and financial markets; risks and uncertainties impacting the proposed Comhear transaction, such as the inability to enter into definitive agreements with respect to the proposed transaction; the expected performance of the parties thereto, risks related to receipt of necessary regulatory and shareholder approvals, failure to realize the anticipated benefits from the transaction; the ability of the parties to satisfy various conditions to closing the proposed transaction; and other risks detailed from time to time in the Company’s filings with the Securities and Exchange Commission, including those described in “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2022, as revised or updated for any material changes described in any subsequently-filed Quarterly Reports on Form 10-Q, and the preliminary and definitive proxy statement, or other document(s) that WiSA intends to file with the SEC in connection with the proposed Comhear transaction. The information in this presentation is as of the date hereof and the Company undertakes no obligations to update unless required to do so by law. * WiSA Ready TVs, gaming PCs and console systems are "ready" to transmit audio to WiSA Certified speakers when a WiSA USB Transmitter is plugged in and a user interface is activated through an APP or product design like LG TVs. © SoundSend, The WiSA logo, WiSA, WiSA Ready, and WiSA Certified are trademarks, or certification marks of WiSA LLC. Third-party trade names, trademarks and product names are the intellectual property of their respective owners and product names are the intellectual property of their respective owners. |

| What is Multi-Channel Spatial Audio? 3 Spatial audio refers to an audio experience that uses multiple and separate channels of audio played back on multiple discrete speakers to create an immersive audio experience that leverages a 360- degree space WiSA powers a wireless spatial audio experience, enabling the transmission of multi-channel, high-bitrate, uncompressed audio streams to deliver an immersive spatial audio experience without the need for a traditional wired solution |

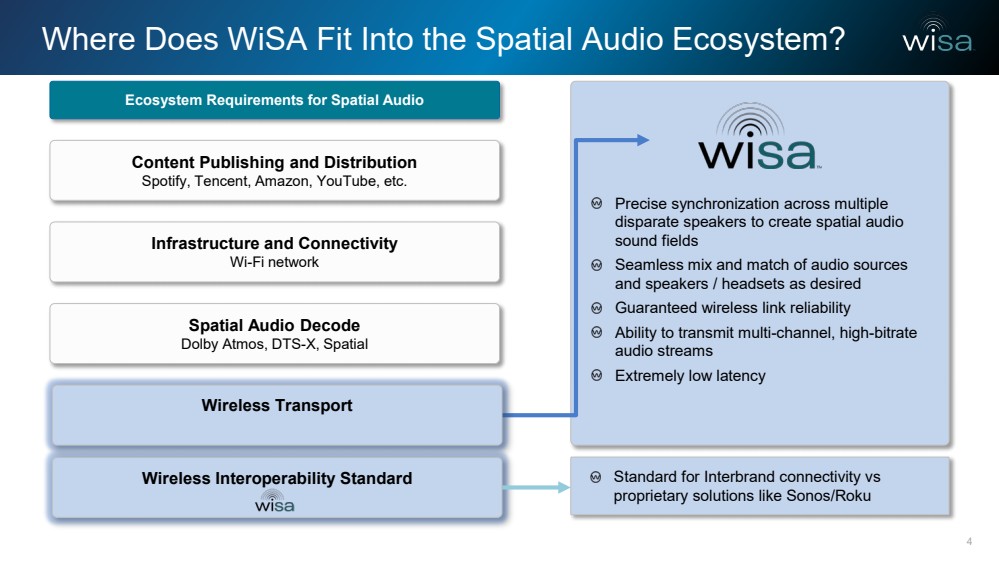

| Where Does WiSA Fit Into the Spatial Audio Ecosystem? 4 Standard for Interbrand connectivity vs proprietary solutions like Sonos/Roku Content Publishing and Distribution Spotify, Tencent, Amazon, YouTube, etc. Infrastructure and Connectivity Wi-Fi network Spatial Audio Decode Dolby Atmos, DTS-X, Spatial Ecosystem Requirements for Spatial Audio Wireless Interoperability Standard Precise synchronization across multiple disparate speakers to create spatial audio sound fields Seamless mix and match of audio sources and speakers / headsets as desired Guaranteed wireless link reliability Ability to transmit multi-channel, high-bitrate audio streams Extremely low latency Wireless Transport |

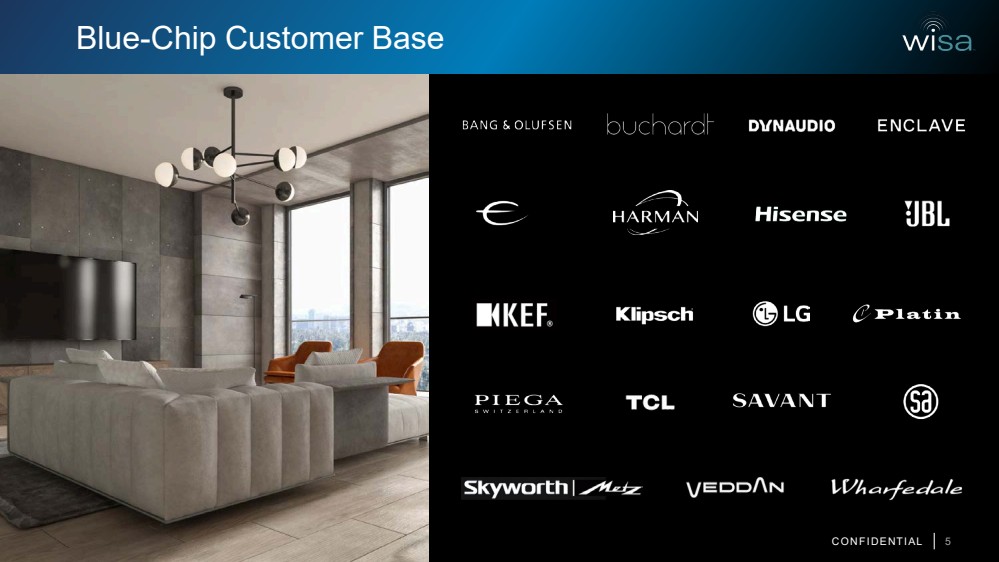

| Blue-Chip Customer Base CONFIDENTIAL 5 |

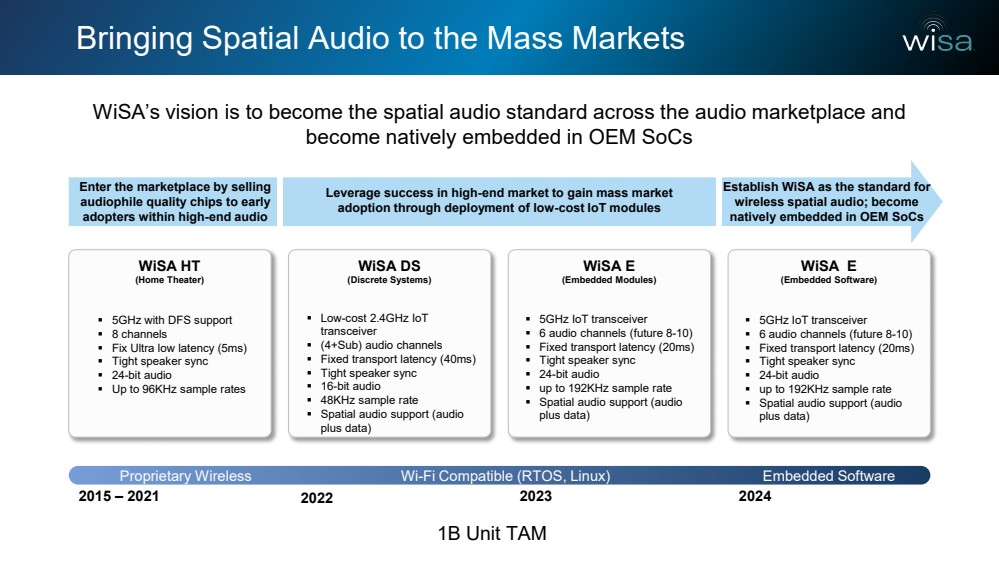

| Bringing Spatial Audio to the Mass Markets 2015 – 2021 2022 2023 2024 Proprietary Wireless Wi-Fi Compatible (RTOS, Linux) WiSA HT (Home Theater) WiSA DS (Discrete Systems) WiSA E (Embedded Modules) WiSA E (Embedded Software) Enter the marketplace by selling audiophile quality chips to early adopters within high-end audio Leverage success in high-end market to gain mass market adoption through deployment of low-cost IoT modules Establish WiSA as the standard for wireless spatial audio; become natively embedded in OEM SoCs 5GHz with DFS support 8 channels Fix Ultra low latency (5ms) Tight speaker sync 24-bit audio Up to 96KHz sample rates Low-cost 2.4GHz IoT transceiver (4+Sub) audio channels Fixed transport latency (40ms) Tight speaker sync 16-bit audio 48KHz sample rate Spatial audio support (audio plus data) 5GHz IoT transceiver 6 audio channels (future 8-10) Fixed transport latency (20ms) Tight speaker sync 24-bit audio up to 192KHz sample rate Spatial audio support (audio plus data) 5GHz IoT transceiver 6 audio channels (future 8-10) Fixed transport latency (20ms) Tight speaker sync 24-bit audio up to 192KHz sample rate Spatial audio support (audio plus data) WiSA’s vision is to become the spatial audio standard across the audio marketplace and become natively embedded in OEM SoCs Embedded Software 1B Unit TAM |

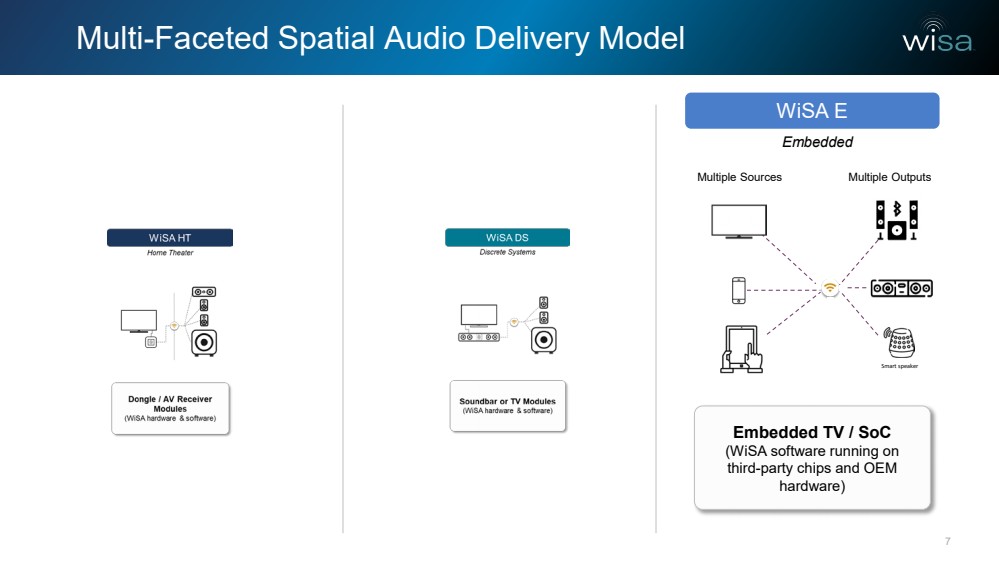

| Multi-Faceted Spatial Audio Delivery Model 7 WiSA E Embedded TV / SoC (WiSA software running on third-party chips and OEM hardware) Multiple Sources Multiple Outputs Smart speaker Embedded |

| WiSA E Opportunity: Recognition • Portland Team deserves a big shout out on achieving the critical goal of shipping WiSA development kits to our strategic customers this quarter • WiSA E and its ability to be embedded on SoCs in soundbars, smart TVs and other consumer devices with software and deliver high quality, wireless multi-channel audio that is easy to set up and delivers immersive audio using Dolby Atmos and DTS X has been the goal of WiSA from the beginning. • Beyond our own team, I want to thank key people that worked with us at Espressif, Realtek, Sunplus and strategic customers. |

| WiSA E Opportunity: The Effort • In January 2022, we announced a partnership with Realtek launch WiSA E’s software on their 5Ghz IoT chip. • With this announcement, two initiatives were launched at WiSA: • The technical challenge of porting our IP to the first 5 Ghz Wi-Fi chip • The business partnership discussions with strategic customers to refine the performance requirements, the feature set they needed, and the pricing. |

| WiSA E Opportunity: The Milestones • The July 25th release announced critical software tools for large, multinational CE companies. These companies use multiple SoC chips in their TVs and soundbars. • These tools facilitate the ability to port WiSA E’s IP from one TV SoC to another while allowing the audio divisions to design one wireless technology across all price points. • The July 27th release was the culmination of our design work and customer input when we announced shipping the development kits to strategic customers with WiSA E’s software. |

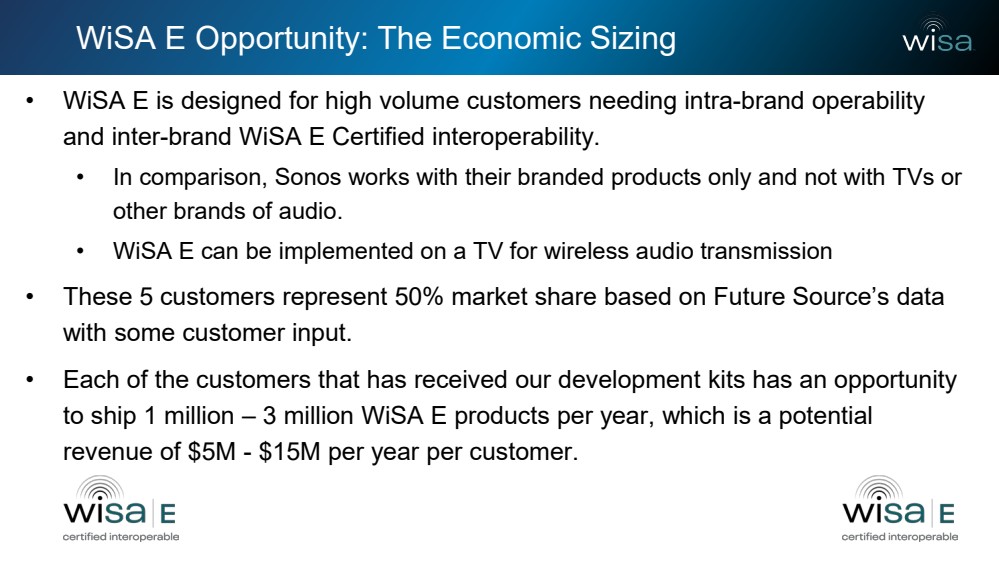

| WiSA E Opportunity: The Economic Sizing • WiSA E is designed for high volume customers needing intra-brand operability and inter-brand WiSA E Certified interoperability. • In comparison, Sonos works with their branded products only and not with TVs or other brands of audio. • WiSA E can be implemented on a TV for wireless audio transmission • These 5 customers represent 50% market share based on Future Source’s data with some customer input. • Each of the customers that has received our development kits has an opportunity to ship 1 million – 3 million WiSA E products per year, which is a potential revenue of $5M - $15M per year per customer. |

| WiSA HT and DS • WiSA HT will building the WiSA ecosystem for years to come. • New members and products will be announced in September at CEDIA. • New designs from Tier 1 brands are expected to launch at CES ‘24, in January. • WiSA DS will launch its first soundbar under Platin Audio in October. This product is expected set new price/performance stands in the soundbar market by using WiSA DS. • Other designs and brands are scheduled to launch later this year. |

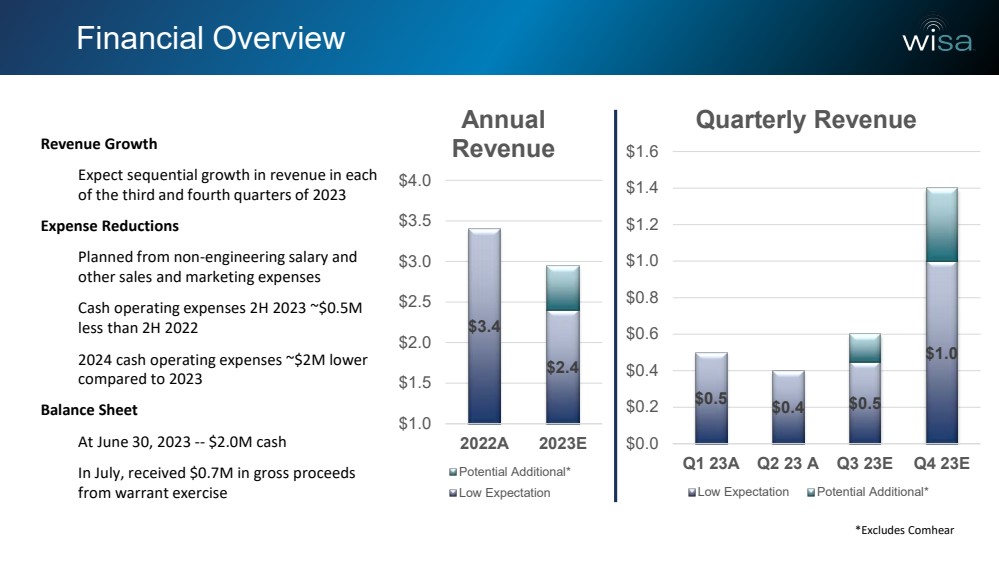

| Revenue Growth • Expect sequential growth in revenue in each of the third and fourth quarters of 2023 Expense Reductions • Planned from non-engineering salary and other sales and marketing expenses • Cash operating expenses 2H 2023 ~$0.5M less than 2H 2022 • 2024 cash operating expenses ~$2M lower compared to 2023 Balance Sheet • At June 30, 2023 -- $2.0M cash • In July, received $0.7M in gross proceeds from warrant exercise Financial Overview $0.5 $0.4 $0.5 $1.0 $0.0 $0.2 $0.4 $0.6 $0.8 $1.0 $1.2 $1.4 $1.6 Q1 23A Q2 23 A Q3 23E Q4 23E Quarterly Revenue Low Expectation Potential Additional* *Excludes Comhear $3.4 $2.4 $1.0 $1.5 $2.0 $2.5 $3.0 $3.5 $4.0 2022A 2023E Annual Revenue Potential Additional* Low Expectation |

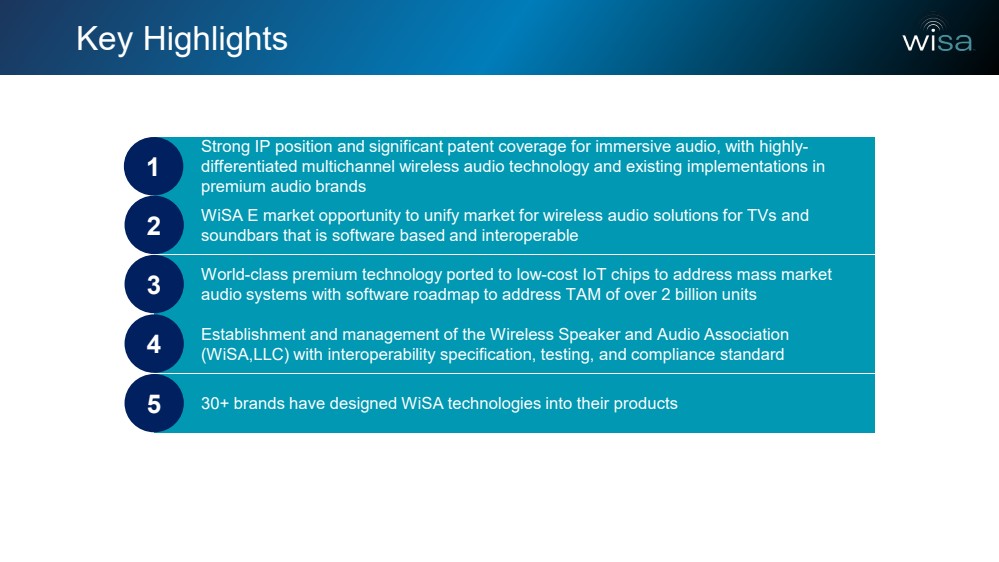

| Key Highlights World-class premium technology ported to low-cost IoT chips to address mass market 3 audio systems with software roadmap to address TAM of over 2 billion units Establishment and management of the Wireless Speaker and Audio Association 4 (WiSA,LLC) with interoperability specification, testing, and compliance standard 5 30+ brands have designed WiSA technologies into their products WiSA E market opportunity to unify market for wireless audio solutions for TVs and 2 soundbars that is software based and interoperable Strong IP position and significant patent coverage for immersive audio, with highly-differentiated multichannel wireless audio technology and existing implementations in premium audio brands 1 |

| WiSA and Platin Audio |