Exhibit 99.1

Proposed Business Combination September 4, 2024

Forward Looking Statements 2 This presentation of WiSA Technologies, Inc . (NASDAQ : WISA) (the “Company” or “ WiSA ”) contains forward - looking statements within the meaning of Section 27 A of the Securities Act of 1933 , as amended (the “Securities Act”), and Section 21 E of the Securities Exchange Act of 1934 , as amended . These forward - looking statements, include, among others, the Company’s and Datavault’s expectations with respect to the proposed Business Combination between them, including statements regarding the benefits of the Business Combination, the anticipated timing of the Business Combination, the implied valuation of Datavault , the products offered by Datavault and the markets in which it operates, and the Company’s and Datavault’s projected future results . Readers are cautioned not to place undue reliance on these forward - looking statements . Actual results may differ materially from those indicated by these forward - looking statements as a result of a variety of factors, including, but are not limited to, risks and uncertainties impacting WiSA’s business including, risks related to our current liquidity position and the need to obtain additional financing to support ongoing operations, our ability to continue as a going concern ; our ability to maintain the listing of our common stock on Nasdaq and other drivers, our ability to predict the timing of design wins entering production and the potential future revenue associated with design wins ; rate of growth ; the ability to predict customer demand for existing and future products and to secure adequate manufacturing capacity ; consumer demand conditions affecting customers’ end markets ; the ability to hire, retain and motivate employees ; the effects of competition, including price competition ; technological, regulatory and legal developments ; developments in the economy and financial markets ; potential harm caused by software defects, computer viruses and development delays ; risks related to our proposed Business Combination, including our ability to obtain stockholder approval and any regulatory approvals required to consummate the transactions and our ability to realize some or all of the anticipated benefits therefrom, which may be affected by, among other things, costs related to the Business Combination, competition and the ability of the post - combination company to grow and manage growth profitability and retain its key employees ; the risk that the Business Combination may not be completed in a timely manner or at all, which may adversely affect the price of the Company’s securities ; the occurrence of any event, change or other circumstance that could give rise to the termination of the Merger Agreement ; the receipt of an unsolicited offer from another party for an alternative transaction that could interfere with the Business Combination ; the effect of the announcement or pendency of the Business Combination on our and Datavault’s business relationships, performance, and business generally ; the outcome of any legal proceedings that may be instituted against us or Datavault following the announcement of the proposed Business Combination ; the risk of any investigations by the SEC or other regulatory authority relating to any future financing, the Merger Agreement or the Business Combination and the impact they may have on consummating the transactions ; the ability to implement business plans, forecasts, and other expectations after the completion of the proposed Business Combination, and identify and realize additional opportunities ; any risks that may adversely affect the business, financial condition and results of operations of Datavault , including the risk that Datavault is unable to secure or protect its intellectual property ; our ability to protect our intellectual property ; the post - combination company’s ability to establish, maintain and enforce effective risk management policies and procedures ; the post - combination company’s ability to protect its systems and data from continually evolving cybersecurity risks, security breaches and other technological risks ; the risk that the post - combination company’s securities will not be approved for listing on Nasdaq or if approved, maintain the listing ; and other risks detailed from time to time in the Company’s filings with the U . S . Securities and Exchange Commission . The information in this presentation is as of the date hereof and neither the Company nor Datavault undertakes no obligations to update unless required to do so by law . The reader is cautioned not to place under reliance on forward looking statements . Neither the Company nor Datavault gives any assurance that either the Company or Datavault , or the post - combination company, will achieve its expectations . This presentation shall not constitute a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the proposed Business Combination . This presentation shall not constitute an offer to sell, or the solicitation of an offer to buy, nor will there be any sale of these securities in any state or other jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of such state or jurisdiction . No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act, or an exemption therefrom .

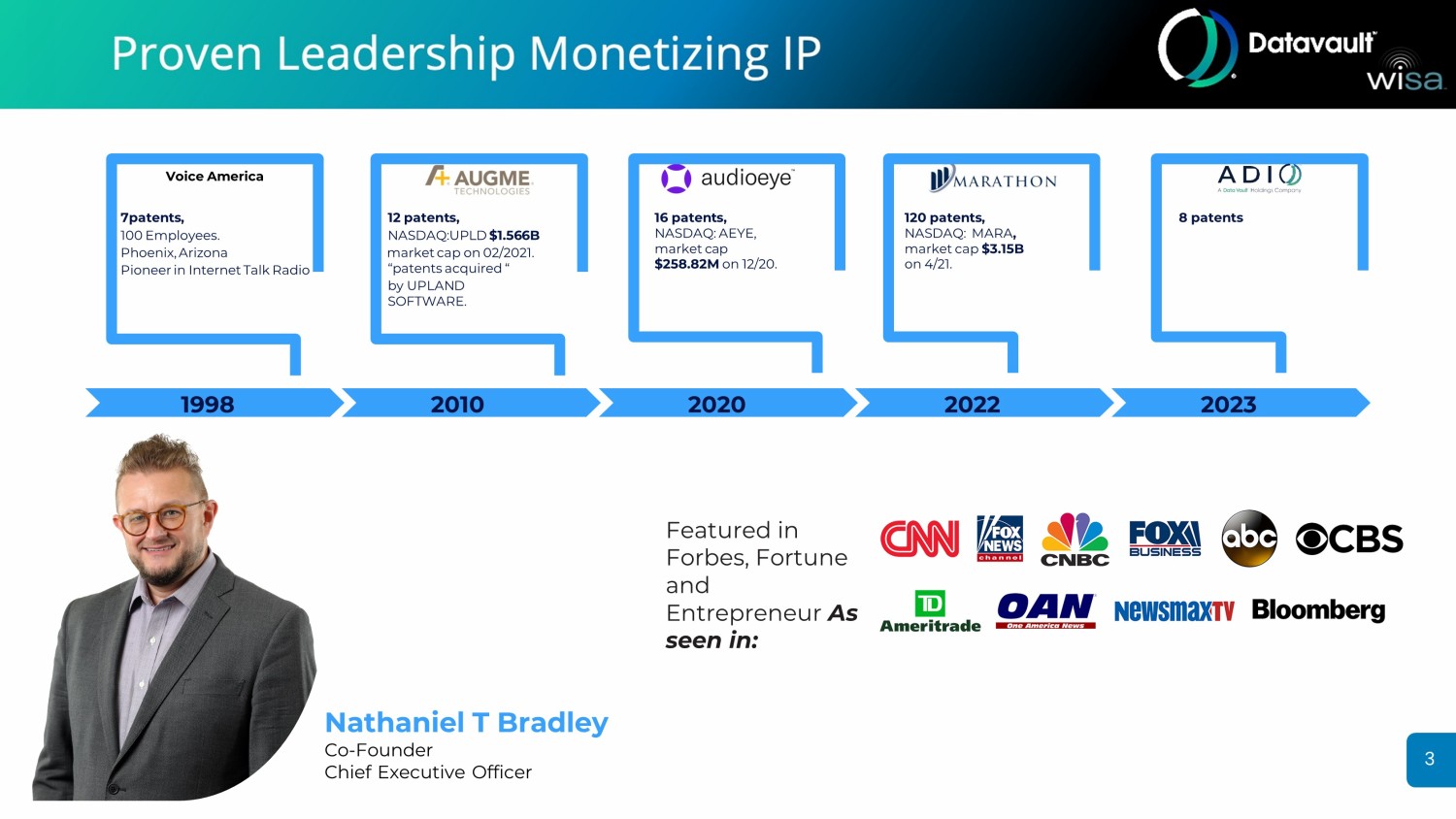

1998 20 20 20 10 20 22 20 23 12 patents, NASDAQ:UPLD $1.566B market cap on 02/2021. “patents acquired “ by UPLAND SOFTWARE. 120 patents, NASDAQ: MARA , market cap $3.15B on 4/21. 16 patents, NASDAQ: AEYE, market cap $258.82M on 12/20. 8 patents Voice America 7 patents, 100 Employees. Phoenix, Arizona Pioneer in Internet Talk Radio Featured in Forbes, Fortune and Entrepreneur As seen in: Nathaniel T Bradley Co - Founder Chief Executive Officer 3

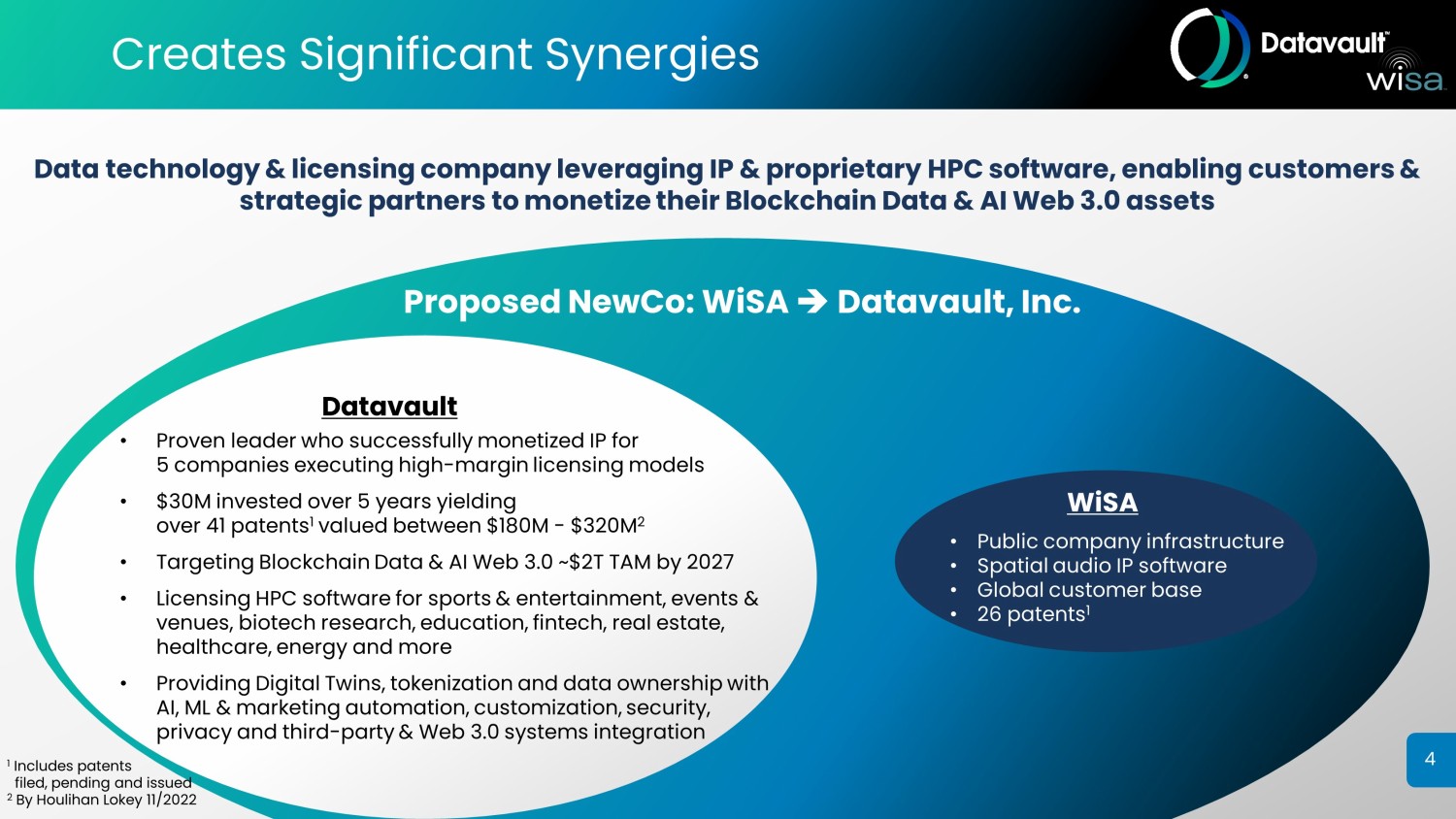

Creates Significant Synergies 4 Proposed NewCo : WiSA Datavault , Inc. Data technology & licensing company leveraging IP & proprietary HPC software, enabling customers & strategic partners to monetize their Blockchain Data & AI Web 3.0 assets 1 Includes patents filed, pending and issued 2 By Houlihan Lokey 11/2022 WiSA • Public company infrastructure • Spatial audio IP software • Global customer base • 26 patents 1 Datavault • Proven leader who successfully monetized IP for 5 companies executing high - margin licensing models • $30M invested over 5 years yielding over 41 patents 1 valued between $180M - $320M 2 • Targeting Blockchain Data & AI Web 3.0 ~$2T TAM by 2027 • Licensing HPC software for sports & entertainment, events & venues, biotech research, education, fintech, real estate, healthcare, energy and more • Providing Digital Twins, tokenization and data ownership with AI, ML & marketing automation, customization, security, privacy and third - party & Web 3.0 systems integration

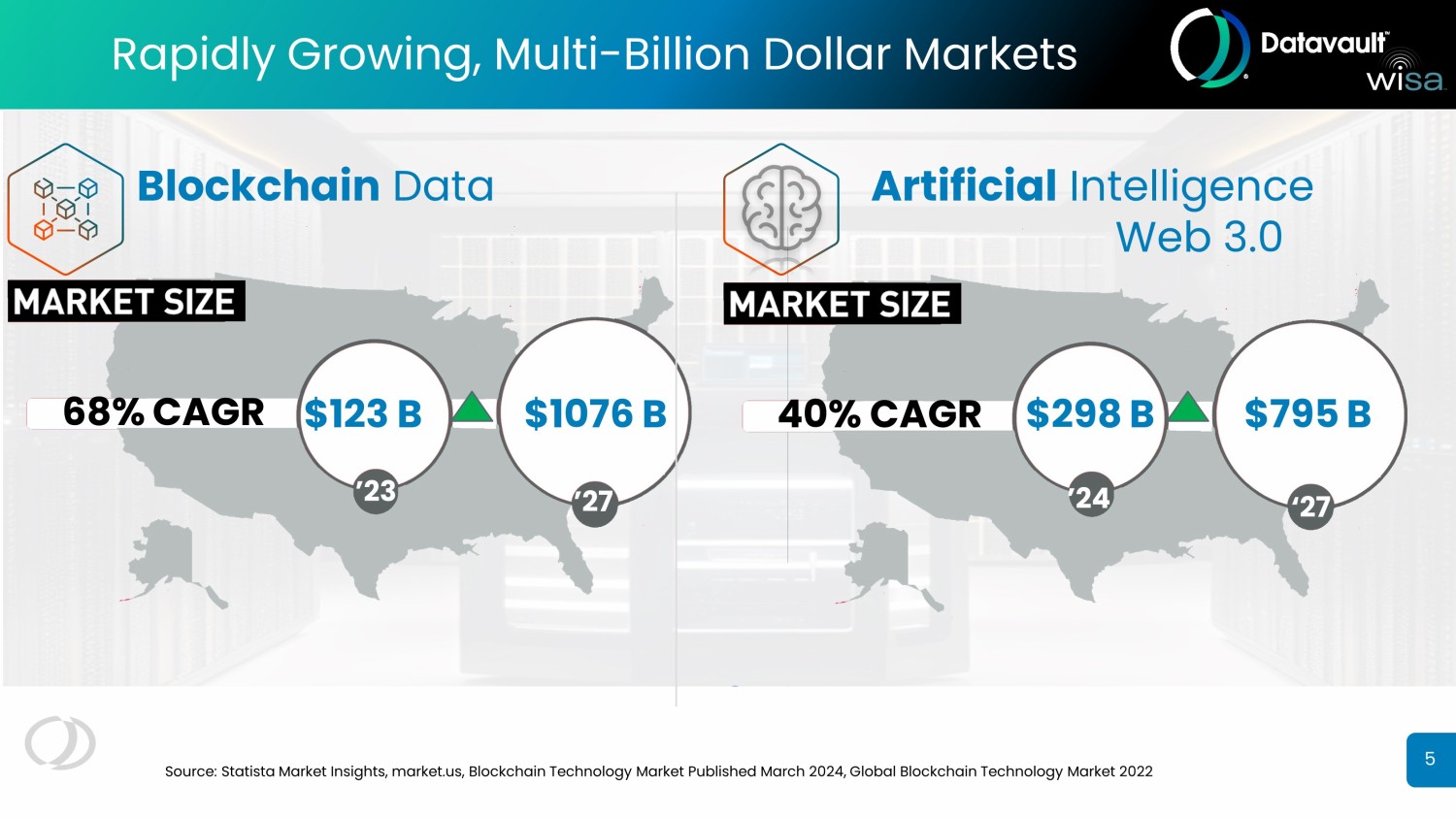

Blockchain Data Artificial Intelligence Web 3.0 Rapidly Growing, Multi - Billion Dollar Markets $ 1076 B $ 795 B $298 B 40% CAGR 68% CAGR ’24 ‘27 ’23 ’27 $123 B Source: Statista Market Insights, market.us, Blockchain Technology Market Published March 2024, Global Blockchain Technology Mar ket 2022 5

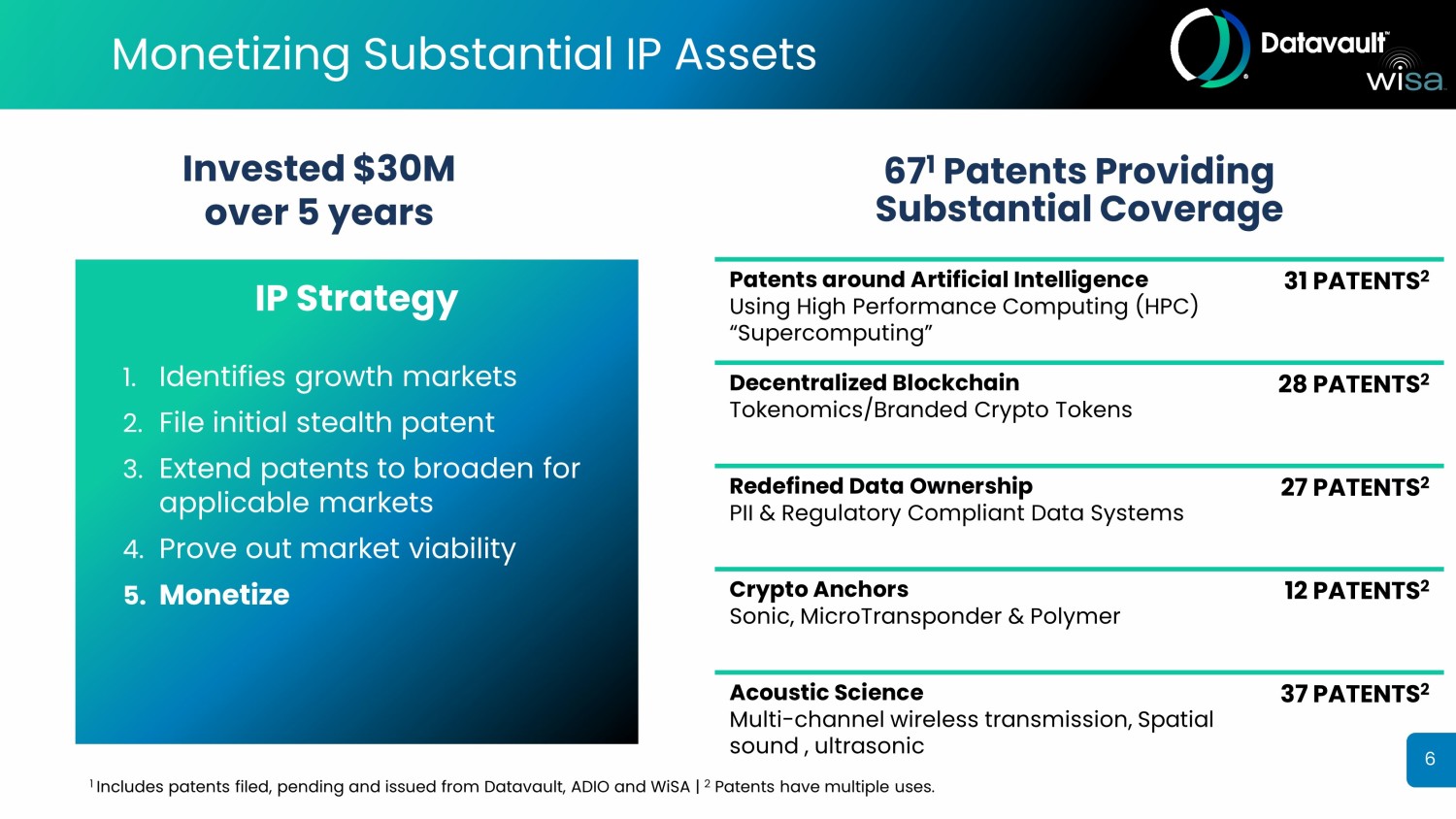

6 67 1 Patents Providing Substantial Coverage IP Strategy 1. Identifies growth markets 2. File initial stealth patent 3. Extend patents to broaden for applicable markets 4. Prove out market viability 5. Monetize Monetizing Substantial IP Assets Invested $ 30M over 5 years 1 Includes patents filed, pending and issued from Datavault, ADIO and WiSA | 2 Patents have multiple uses. 31 PATENTS 2 Patents around Artificial Intelligence Using High Performance Computing ( HPC ) “Supercomputing” 28 PATENTS 2 Decentralized Blockchain Tokenomics /Branded Crypto Tokens 27 PATENTS 2 Redefined Data Ownership PII & Regulatory Compliant Data Systems 12 PATENTS 2 Crypto Anchors Sonic, MicroTransponder & Polymer 37 PATENTS 2 Acoustic Science Multi - channel wireless transmission, Spatial sound , ultrasonic 6

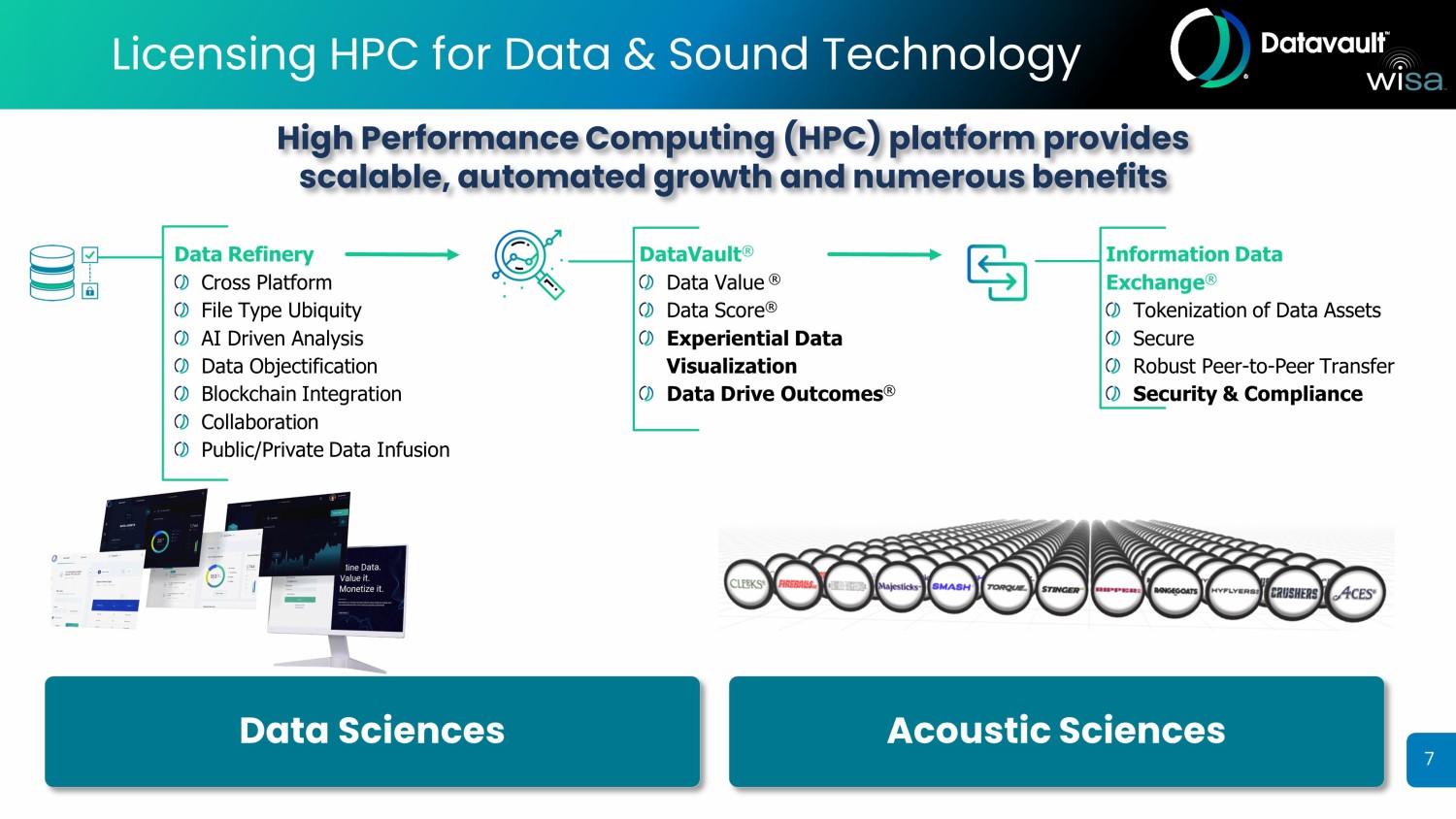

Licensing HPC for Data & Sound Technology Data Sciences Acoustic Sciences High Performance Computing (HPC) platform provides scalable, automated growth and numerous benefits 7 Data Refinery Cross Platform File Type Ubiquity AI Driven Analysis Data Objectification Blockchain Integration Collaboration Public/Private Data Infusion DataVault ® Data Value ® Data Score ® Experiential Data Visualization Data Drive Outcomes ® Information Data Exchange ® Tokenization of Data Assets Secure Robust Peer - to - Peer Transfer Security & Compliance

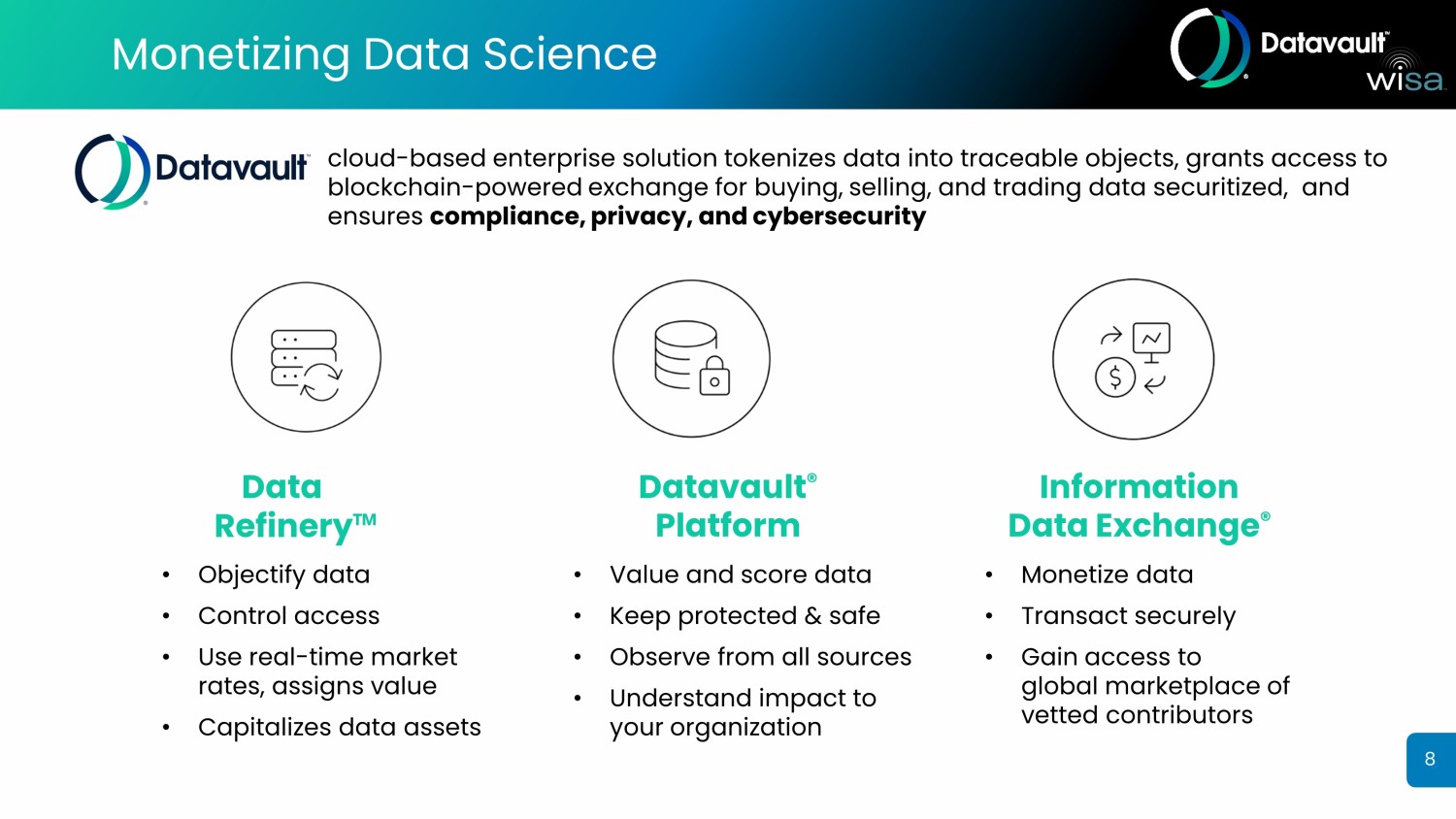

Monetizing Data Science cloud - based enterprise solution t okenizes data into traceable objects, grants access to blockchain - powered exchange for buying, selling, and trading data securitized, and ensures compliance, privacy, and cybersecurity Information Data Exchange ® Datavault ® Platform Data Refinery • Monetize data • Transact securely • Gain access to global marketplace of vetted contributors • Value and score data • Keep protected & safe • Observe from all sources • Understand impact to your organization • Objectify data • Control access • Use real - time market rates, assigns value • Capitalizes data assets 8

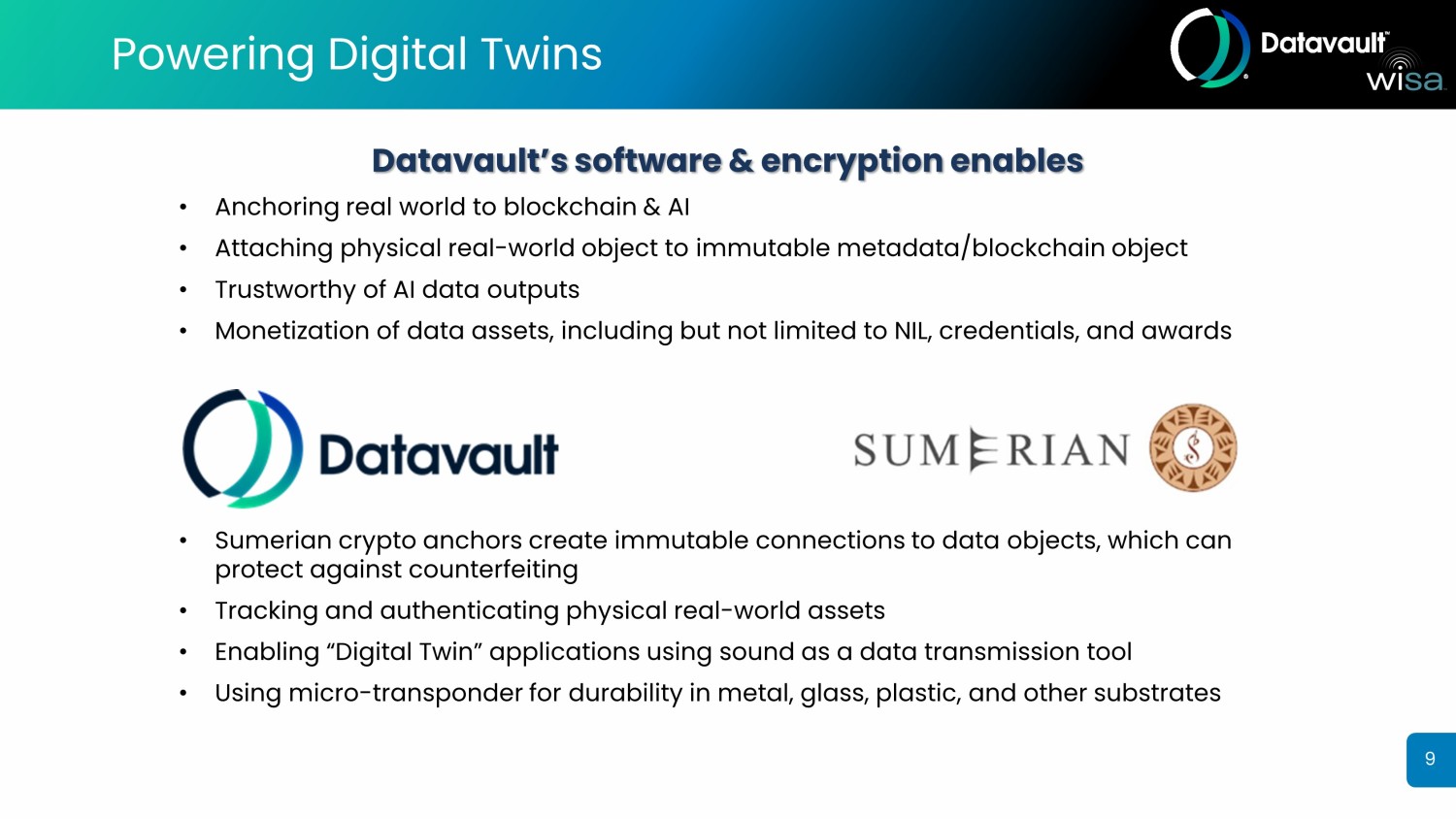

Powering Digital Twins 9 Datavault’s software & encryption enables • Anchoring real world to blockchain & AI • Attaching physical real - world object to immutable metadata/blockchain object • Trustworthy of AI data outputs • Monetization of data assets, including but not limited to NIL, credentials, and awards • Sumerian crypto anchors create immutable connections to data objects, which can protect against counterfeiting • Tracking and authenticating physical real - world assets • Enabling “Digital Twin” applications using sound as a data transmission tool • Using micro - transponder for durability in metal, glass, plastic , and other substrates

Yogi Berra & Aflac Insurance Authentic Yogi Berra Digital Twin provides detailed understanding of coverages, policies, contract info, prices and more Enterprise License - Hypothetical Example • 50 States, 250 Agents • $2,250/ mo /agent $ 562,500 Monthly total (70/30 split) $ 168,750 Datavault * $ 393,750 Yogi Berra Foundation + Agent * Datavault installs, manages, operates, supports, updates and improves digital twin. Sports & Entertainment Real - world Applications Licensing of Name, Image, Likeness • Generating revenue using tokenized smart contracts to split among data/images owner, agent/estate and Datavault • Hologram, CGI and AI voice likeness maximize the yield and utility • Current and past icons • Opportunities exist in perpetuity 10 Digital Assets Never Die

Education Real - world Applications 11 • Generates immutable metadata that indexes, scores and prices data of all types in Web 3.0 • Creates value through scarcity, utility and encrypted data protection • Ensures identity of credentialed graduates is verifiable over patented sonic data verification VerifyU TM - Universities Tokenize Credentials, Degrees and Memorabilia • Student athletes have a new opportunity to generate revenue through NIL • Datavault provides the only patented platform for the management of NIL for colleges and universities • Smart contracts ensure income is distributed between student, university, and Datavault Student Athletes: High School through College

Monetizing Acoustic Science Patented data over sound, spatial control of it and the industry standard in multi - channel wireless transmission quality only from • Spatial, 3D multi - channel, transmission technology • Installed global base • WiSA E Software • WiSA Association • Data over sound • Ultrasonic anchor • Data tone transmission • Mobile response receiver platform allows for complete management of ultrasonic tones • Ad Network & Signage • Sports & Entertainment Venues 12

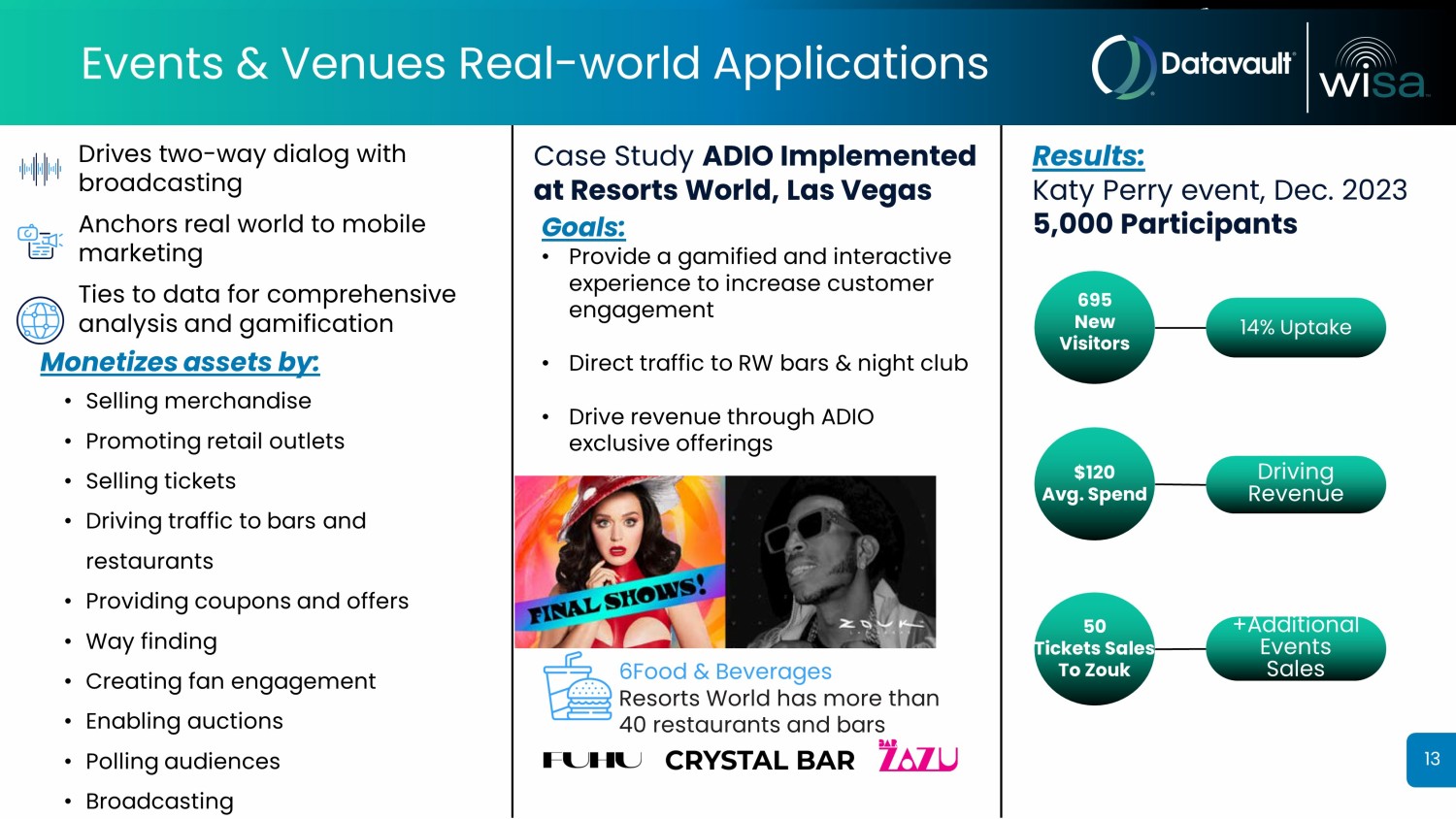

Events & Venues Real - world Applications 6Food & Beverages Resorts World has more than 40 restaurants and bars Case Study ADIO Implemented at Resorts World, Las Vegas Goals: • Provide a gamified and interactive experience to increase customer engagement • Direct traffic to RW bars & night club • Drive revenue through ADIO exclusive offerings Results: Katy Perry event, Dec. 2023 5,000 Participants 695 New Visitors 14% Uptake $120 Avg. Spend Driving Revenue 50 Tickets Sales To Zouk +Additional Events Sales Monetizes assets by: • Selling merchandise • Promoting retail outlets • Selling tickets • Driving traffic to bars and restaurants • Providing coupons and offers • Way finding • Creating fan engagement • Enabling auctions • Polling audiences • Broadcasting Drives two - way dialog with broadcasting Anchors real world to mobile marketing Ties to data for comprehensive analysis and gamification 13

Driving Revenue from Platform Technology • AI & ML Automation • Completely Customizable • Generate Revenue from Data • Detailed Analytics & Data • Digital Ownership • Marketing Automation • Monitoring Advertising • Privacy Protection • Protect Credentials • Third - Party Integration • Tokenization • Web 3.0 Systems Integration 14

Trusted By Global Leaders Super Computing (HPC) Tokenized Data Exchange Spatial Audio Sports, entertainment, live event venues, concerts, convention centers 15

Licensing Model Engagement Fee • Engineering services • Software license Software as a Service (SaaS) Licensing • Annual, recurring and/or per transaction or event Information Data Exchange ® (IDE) Transaction Fees • Carried interest in customers’ data assets 16

Transaction Summary Upon Shareholder Approval Asset Purchase Agreement $210M paid to Data Vault Holdings Inc. in exchange for Datavault and ADIO IP & IT assets o $200M in the form of shares of restricted common stock of WiSA Technologies to be issued at $5.00/share o $10M in an unsecured promissory Note due 3 years from closing , with 10% of the proceeds of any financings used to pay down or pay off the Note in the interim 3% royalty on future revenues from Datavault and ADIO product lines to be paid to Master Vault, LLC o ver the life of the patents Closing Expectations • To mail proxy around the end of September, with the stockholder meeting to be held in Q4, 2024 • Closing is expected prior to Dec. 31, 2024, subject to customary conditions and approval by WiSA stockholders Post Closing Highlights • Change name to Datavault • Name Nate Bradley as CEO & Brett Moyer as CFO 17

Data Technology & Licensing Company CEO, a proven leader, leveraging his experience commercializing and successfully monetizing an IP portfolio for 5 licensing companies 6 th IP Company IP and patents targeting AI applications, decentralized blockchain, redefined data ownership, crypto anchors and acoustic science 67 Patents Blockchain data + AI Web 3.0 growing TAM expected to reach ~$ 2B by 2027 for solutions enabling customers to monetize their digital assets Large, Growing AI & Blockchain Markets HPC software licensing for sports & entertainment, events & venues, biotech, education, fintech, real estate, healthcare, energy and more High - margin Licensing Model Solutions providing Digital Twins, tokenization, data ownership and more with AI, ML & marketing automation, customization, security, privacy and third - party & Web 3.0 systems integration Traction with Global Customers 18