| Third Quarter 2024 and Transaction Update November 15, 2024 |

| Forward Looking Statements 2 This presentation of WiSA Technologies, Inc. (NASDAQ: WISA) (the “Company”, “us”, “our” or “WiSA”) contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements, include, among others, the Company’s and Data Vault Holdings, Inc.’s (“Datavault”) expectations with respect to the proposed asset purchase (the “Asset Purchase) between them, including statements regarding the benefits of the Asset Purchase, the anticipated timing of the Asset Purchase, the implied valuation of Datavault, the products offered by Datavault and the markets in which it operates, and the Company’s and Datavault’s projected future results and market opportunities, as well as information with respect to WiSA’s future operating results and business strategy. Readers are cautioned not to place undue reliance on these forward-looking statements. Actual results may differ materially from those indicated by these forward-looking statements as a result of a variety of factors, including, but are not limited to: (i) risks and uncertainties impacting WiSA’s business including, risks related to its current liquidity position and the need to obtain additional financing to support ongoing operations, WiSA’s ability to continue as a going concern, WiSA’s ability to maintain the listing of its common stock on Nasdaq, WiSA’s ability to predict the timing of design wins entering production and the potential future revenue associated with design wins, WiSA’s ability to predict its rate of growth, WiSA’s ability to predict customer demand for existing and future products and to secure adequate manufacturing capacity, consumer demand conditions affecting WiSA’s customers’ end markets, WiSA’s ability to hire, retain and motivate employees, the effects of competition on WiSA’s business, including price competition, technological, regulatory and legal developments, developments in the economy and financial markets, and potential harm caused by software defects, computer viruses and development delays, (ii) risks related to the Asset Purchase, including WiSA’s ability to close the Asset Purchase in a timely manner or at all, or on the terms anticipated, whether due to WiSA’s ability to satisfy the applicable closing conditions and secure stockholder approval from WiSA stockholders or otherwise, as well as risks related to WiSA’s ability to realize some or all of the anticipated benefits from the Asset Purchase, (iii) any risks that may adversely affect the business, financial condition and results of operations of Datavault, including but not limited to cybersecurity risks, the potential for AI design and usage errors, risks related to regulatory compliance and costs, potential harm caused by data privacy breaches, digital business interruption and geopolitical risks, and (iv) other risks as set forth from time to time in WiSA’s filings with the U.S. Securities and Exchange Commission (the “SEC”). The information in this presentation is as of the date hereof and neither the Company nor Datavault undertakes any obligation to update such information unless required to do so by law. The reader is cautioned not to place under reliance on forward looking statements. Neither the Company nor Datavault gives any assurance that either the Company or Datavault will achieve its expectations. This presentation shall not constitute an offer to sell, or the solicitation of an offer to buy, nor will there be any sale of these securities in any state or other jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of such state or jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act, or an exemption therefrom. |

| Additional Information 3 Additional Information and Where to Find It In connection with the proposed Asset Purchase, WiSA intends to file with the SEC a definitive proxy statement. The definitive proxy statement for WiSA (if and when available) will be mailed to stockholders of WiSA. WISA STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT AND OTHER DOCUMENTS THAT MAY BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED ASSET PURCHASE. WiSA stockholders will be able to obtain free copies of these documents (if and when available) and other documents containing important information about WiSA and Data Vault, once such documents are filed with the SEC, through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC will also be made available free of charge by contacting WiSA using the contact information below. Participants in the Solicitation WISA and its directors, executive officers and other members of its management and employees may be deemed to be participants in the solicitation of proxies from WiSA’s stockholders in connection with the Asset Purchase. Stockholders are urged to carefully read the proxy statement regarding the Asset Purchase when it becomes available, because it will contain important information. Information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of WiSA’s stockholders in connection with the Asset Purchase will be set forth in the proxy statement when it is filed with the SEC. Information about WiSA’s executive officers and directors will be set forth in the proxy statement relating to the Asset Purchase when it becomes available. You can obtain free copies of these and other documents containing relevant information at the SEC’s web site at www.sec.gov or by directing a request to the address or phone number set forth below. For further information, please contact: WiSA Technologies, Inc. 15268 NW Greenbrier Pkwy Beaverton, OR 97006 (408) 627-4716 |

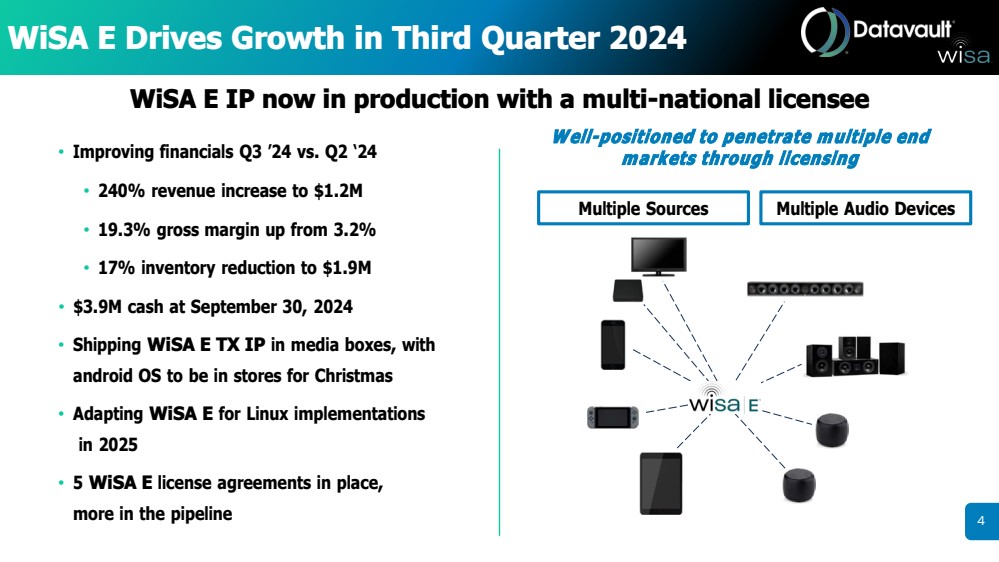

| WiSA E Drives Growth in Third Quarter 2024 WiSA E IP now in production with a multi-national licensee 4 • Improving financials Q3 ’24 vs. Q2 ‘24 • 240% revenue increase to $1.2M • 19.3% gross margin up from 3.2% • 17% inventory reduction to $1.9M • $3.9M cash at September 30, 2024 • Shipping WiSA E TX IP in media boxes, with android OS to be in stores for Christmas • Adapting WiSA E for Linux implementations in 2025 • 5 WiSA E license agreements in place, more in the pipeline Multiple Sources Multiple Audio Devices Well-positioned to penetrate multiple end markets through licensing |

| Transaction Update Asset Purchase Agreement • $210M paid to Data Vault Holdings Inc. in exchange for Datavault® and ADIO® IP assets o $200M in the form of shares of restricted common stock of WiSA Technologies to be issued at $5.00/share o $10M in an unsecured promissory Note due 3 years from closing, with 10% of the proceeds of any financings used to pay down or pay off the Note in the interim • 3% royalty on future revenues from Datavault and ADIO® product lines to be paid to Master Vault, LLC over the life of the patents Closing Expectations • WiSA expects to mail a Definitive Proxy Statement for its Annual Meeting, to be held in December 2024, at which stockholder will have an opportunity to vote to approve the Asset Purchase. If approved by stockholders, WiSA expects that the Asset Purchase will close shortly after the Annual Meeting, subject to satisfaction of customary closing conditions. Post Closing Highlights • Change name to Datavault® • Name Nate Bradley as CEO & Brett Moyer as CFO 5 |

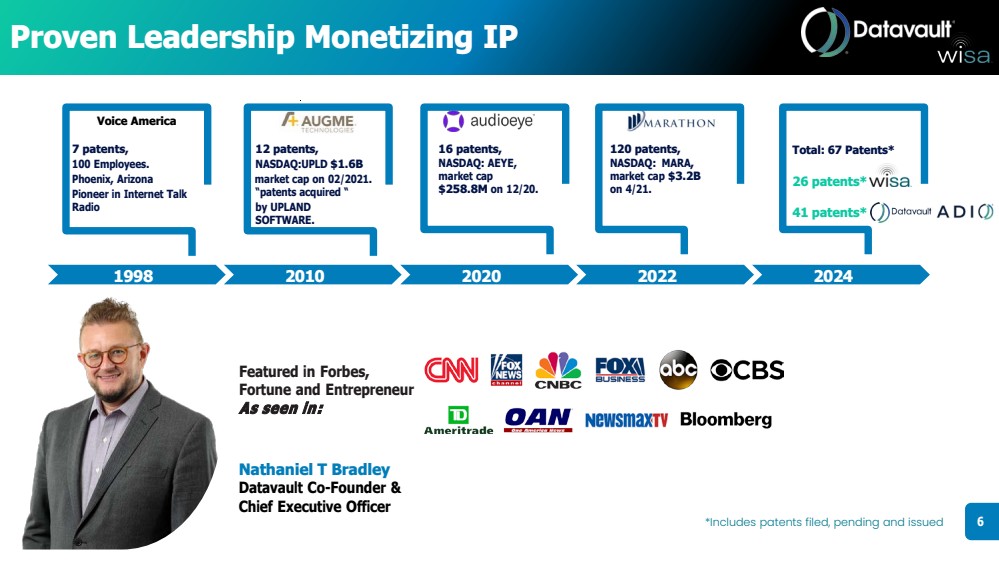

| 1998 2010 2020 2022 2024 12 patents, NASDAQ:UPLD $1.6B market cap on 02/2021. “patents acquired “ by UPLAND SOFTWARE. 120 patents, NASDAQ: MARA, market cap $3.2B on 4/21. 16 patents, NASDAQ: AEYE, market cap $258.8M on 12/20. Voice America 7 patents, 100 Employees. Phoenix, Arizona Pioneer in Internet Talk Radio Featured in Forbes, Fortune and Entrepreneur As seen in: Nathaniel T Bradley Datavault Co-Founder & Chief Executive Officer 6 Total: 67 Patents* 26 patents* 41 patents* Proven Leadership Monetizing IP *Includes patents filed, pending and issued |

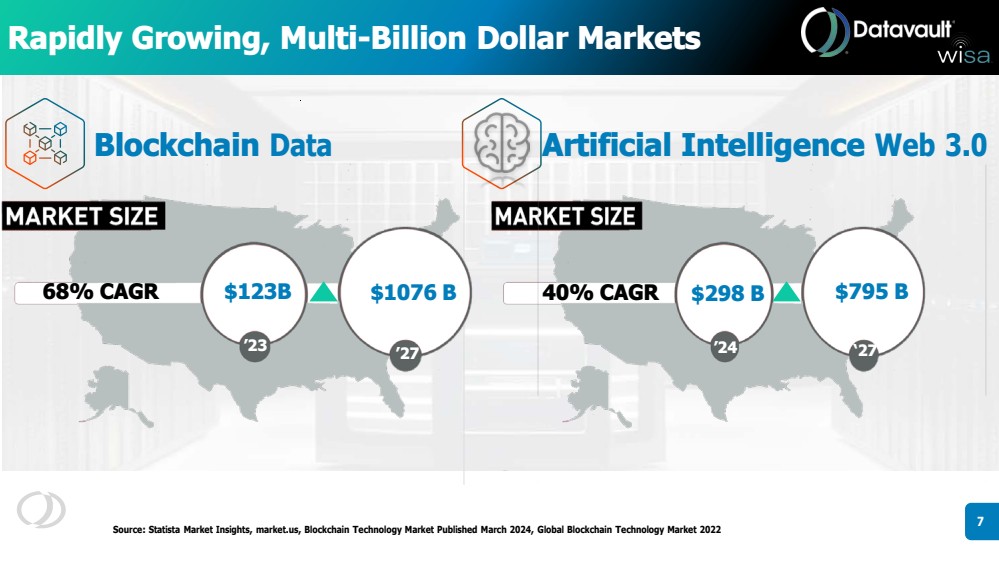

| Blockchain Data Artificial Intelligence Web 3.0 Rapidly Growing, Multi-Billion Dollar Markets 68% CAGR $1076 B 40% CAGR $298 B $795 B ’24 ‘27 ’23 ’27 $123B Source: Statista Market Insights, market.us, Blockchain Technology Market Published March 2024, Global Blockchain Technology Market 2022 7 |

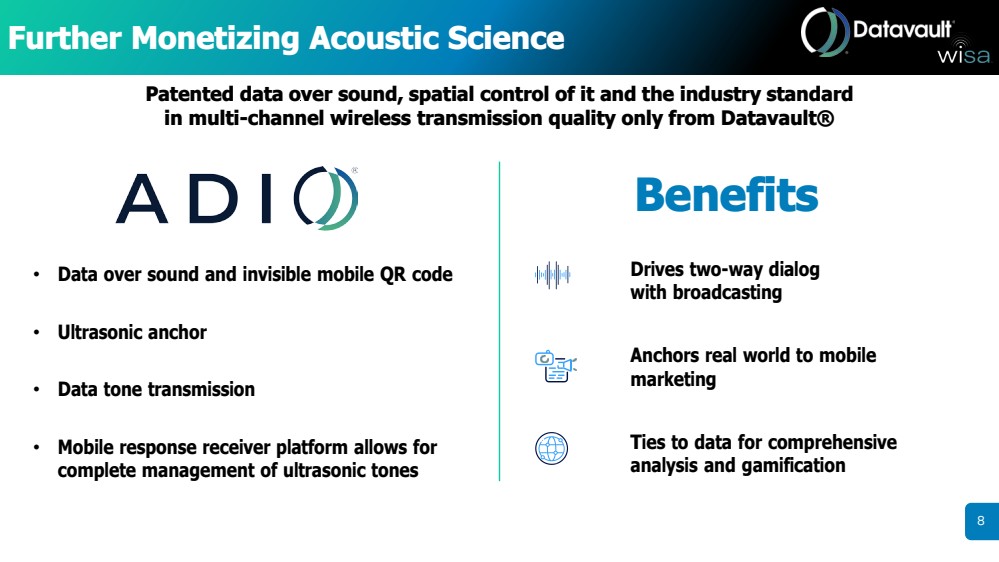

| • Data over sound and invisible mobile QR code • Ultrasonic anchor • Data tone transmission • Mobile response receiver platform allows for complete management of ultrasonic tones Further Monetizing Acoustic Science Patented data over sound, spatial control of it and the industry standard in multi-channel wireless transmission quality only from Datavault® 8 Drives two-way dialog with broadcasting Anchors real world to mobile marketing Ties to data for comprehensive analysis and gamification Benefits |

| Events Market Goals • Increase engagement by gamifying experience • Boost Resorts World revenue • Direct traffic to bars & night club • Offer additional events 14% Visitor Engagement* $120 Average Visitor Spend 7% of Engaged Visitors Bought Additional RW Events Results 9 Concert Event Resorts World, Las Vegas Dec. 2023: 5,000 Participants * 21 years and older Sponsored by Levis & Las Vegas Convention Center to increase wayfinding and brand loyalty statistic game features and commemorative tokens Fostering fan engagement through an innovative game experience • Mobile and Location-Based Marketing • Experiential and Events • E-commerce and Retail Platforms • Content Streaming |

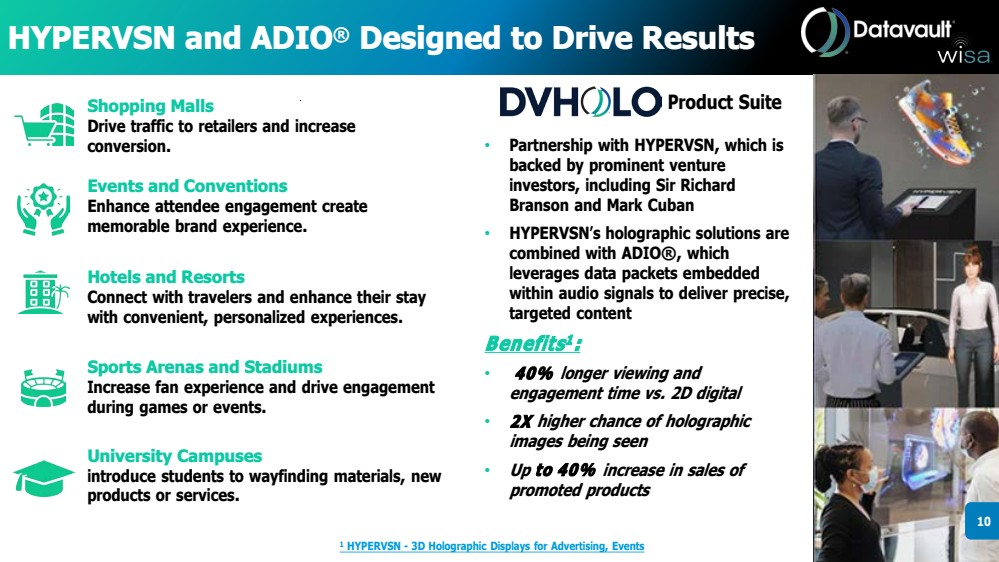

| • Partnership with HYPERVSN, which is backed by prominent venture investors, including Sir Richard Branson and Mark Cuban • HYPERVSN’s holographic solutions are combined with ADIO®, which leverages data packets embedded within audio signals to deliver precise, targeted content Benefits1 : • 40% longer viewing and engagement time vs. 2D digital • 2X higher chance of holographic images being seen • Up to 40% increase in sales of promoted products HYPERVSN and ADIO® Designed to Drive Results 10 1 HYPERVSN - 3D Holographic Displays for Advertising, Events Shopping Malls Drive traffic to retailers and increase conversion. Sports Arenas and Stadiums Increase fan experience and drive engagement during games or events. Product Suite Events and Conventions Enhance attendee engagement create memorable brand experience. Hotels and Resorts Connect with travelers and enhance their stay with convenient, personalized experiences. University Campuses introduce students to wayfinding materials, new products or services. |

| Education Real-World Applications 11 • Generates immutable metadata that indexes, scores and prices data of all types in Web 3.0 • Creates value through scarcity, utility and encrypted data protection • Ensures identity of credentialed graduates is verifiable over patented sonic data verification VerifyU TM - Monetizing Credentials, Degrees and Memorabilia Benefits of Our Platform Protect Credentials Create, mint & issue credentials that are tokenized and encrypted with identity & credential information. Web 3.0 Systems Integration Connect to existing infrastructure to add Web 3.0 blockchain functionality. Manage cohorts and alumni connections through secure and scalable infrastructure. Generate Revenue Develop new revenue through creation of data objects of value and market them on our patented Information Data Exchange. Other Extended Benefits Monetizing Name, Image, Likeness (NIL) NIL market set to grow from $1B in 2024 to $1.7B in 2025* Licensing Supercomputer time for AI course work and research Worldwide shortage of supercomputer infrastructure effecting .edu AI degreed programs *Opendorse. "NIL AT 3: The Annual Opendorse Report." Opendorse, 2024, https://biz.opendorse.com/nil-3-annual-report/ |

| Supercomputing – Digital Twins Symposium 12 The collaboration with a US national labs for High Performance Computing (HPC), focusing on securing 200+ projects across energy, life sciences, agriculture, and healthcare, starting with a custom Phytointel platform, powered by Datavault and HPC. Biodiesel Market Potential: The global biodiesel market is valued between $30B – 40B annually, with about $1.75B attributable to canola oil, assuming a 50% vegetable oil share and a 10% canola oil share within it. This market is growing at an estimated 7%-10% compound annual growth rate. Emerging Demand for Biofuels: Driven by government initiatives like the Renewable Fuel Standard, the biofuel market is projected to surpass $190B by 2027, highlighting opportunities for crops like canola as key biofuel feedstocks. Datavault’s PhytoIntel’s Role in Plant Biotechnology: The PhytoIntel platform, powered by Datavault’s underlying Data Management and Visualization technologies, applies HPC and AI to create predictive models for gene modification, aiming to develop a “Digital Twin” of plant species. This technology supports advancements in plant traits such as yield and stress resistance. Data-Driven Biotechnology for Precision: Unlike traditional approaches, PhytoIntel integrates multi-omics data (genomics, transcriptomics, metabolomics) with AI for a comprehensive, predictive model— promising precision improvements in gene-editing outcomes for plant biotechnology. Canola as a Strategic Biofuel Feedstock: Enhancing canola’s yield and oil quality through biotech solutions positions it well to meet the rising demand for sustainable energy sources, further strengthening its role in the biofuels sector. Source: Biodiesel Market Size & Share, Growth Opportunity 2024-2032 (gminsights.com) North America Biodiesel Market Share, 2032 Statistics Report (gminsights.com) |

| Data Technology & Licensing Company 6th IP Company CEO, a proven leader, leveraging his experience commercializing and successfully monetizing an IP portfolio for 5 licensing companies 67 Patents IP and patents targeting AI applications, decentralized blockchain, redefined data ownership, crypto anchors and acoustic science Large, Growing AI & Blockchain Markets Blockchain data + AI Web 3.0 growing TAM expected to reach ~$2B by 2027 for solutions enabling customers to monetize their digital assets High-margin Licensing Model HPC software licensing for sports & entertainment, events & venues, biotech, education, fintech, real estate, healthcare, energy and more Traction with Global Customers Solutions providing Digital Twins, tokenization, data ownership and more with AI, ML & marketing automation, customization, security, privacy and third-party & Web 3.0 systems integration 13 |

| Thank You November 15, 2024 WiSA & Datavault® Proposed Business Combination Thank You Investor Contact David Barnard, CFA Alliance Advisors Investor Relations wisa@allianceadvisors.com 1-415-433-3777 |